- 3Commas competitor: Cryptohopper review

3 Commas Key Features

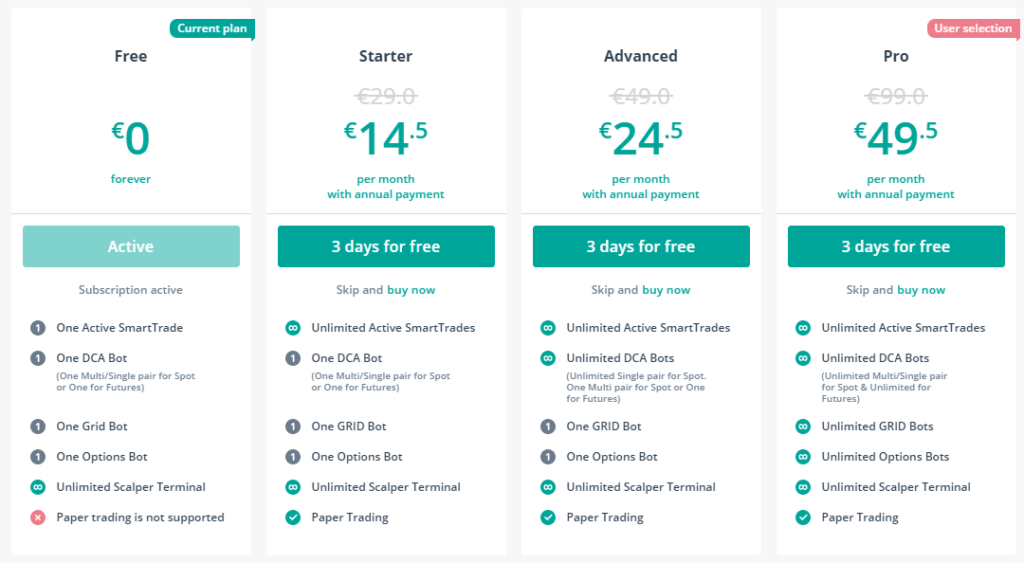

| Price | Free / $14.50 / $24.50 / $49.50 Per Month |

| Fees | $0 Trading Fees |

| Exchange Support | Binance / Binance Futures / Binance.US / Binance Jersey / Binance Margin / Bitmex / Coinbase / Bittrex / OKEX / Huobi / KuCoin / Paper trading / Bybit / Bybit Testnet |

| Payment Options | PayPal / Visa / Mastercard |

| Signals | Marketplace |

| Strategies | 100+ Indicators & Candle Patterns |

| Cloud-Based? | Yes |

Use the link above to get a free trial and 10% off your first month

3Commas Review – General Overview

A general review of 3Commas shows the trading platform grants access to different tools that can positively impact users’ trading experience. Trading bots on the platform operate in conjunction with various devices and exchanges. They continuously execute trade actions based on predetermined parameters set by the trader. 3Commas works with 12 exchanges, including Binance and Coinbase; thus, its users can keep up with various orders on the different exchange platforms and utilize effective stop losses or take profit trading strategies. The next sections of this 3Commas review will cover pros, cons, and unique features to be aware of.Where 3Commas Excels

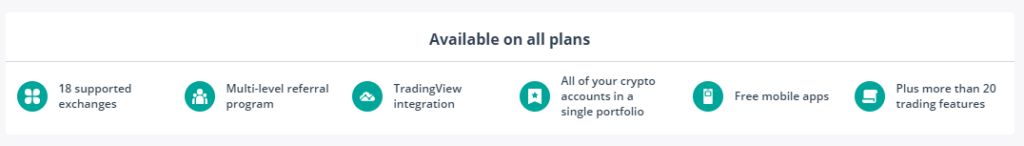

3Commas excels in many areas as an automated trading platform. This 3Commas review will cover some pros of 3Commas including:- 3Commas enlists over 18 cryptocurrency exchanges on its platform, including the major ones like Coinbase and Binance

- It provides for 50 percent savings on annual subscriptions and is generally cost-effective

- It has features that support both manual and automated trading

- 3Commas is globally accessible

- It has a user interface that is compatible with iOS and Android devices

- 3Commas provides beginners with an educational service to improve their knowledge of trading

- The platform offers a paper trading account that users can utilize to backtest trading strategies before executing.

Where 3Commas Can Improve

3Commas has certain areas for improvement. This 3Commas review will go over some cons of 3Commas including:- The platform is not cost-effective for users that trade small volumes.

- Most beginners are not able to utilize the majority of the features on the platform.

- The platform does not provide a desktop application.

- Automated trading is not supported on all exchanges.

3 Commas Unique Features

The 3Commas trading platform has its key features, advantages, and places where improvement can be made.

- Functionality – The platform is web-based, and its features and interface are easy for users. The features on the website include detailed analytics and bots that can be customized to execute a stop loss and take profit targets or for customizing trading actions and strategies.

- Technology – The automated trading bots integrate with cryptocurrency exchanges to ensure users have 24-hour access to their dashboards on multiple devices.

- Range of tools – 3Commas hosts a wide range of trading tools for users to create, analyze and backtest their trading strategies. The tools also allow users to mimic the strategy of successful traders on the platform.

- Exchange integration – Exchanges like Bitfinex, Bitstamp, and KuCoin use automatic trading bots provided by 3Commas.

- Customer support – A constant support team is available to attend to customers’ complaints in English or Russian. The support team can be contacted through the Help center on the platform or via their Twitter, Facebook, and Telegram accounts.

Is 3Commas Safe to Use?

The 3Commas platform prioritizes protecting users’ information, and it requires minimal personal information from users thus reducing associated risks. The other security measures put in place by the platform include:- Login credentials

- Two-factor authentication

- Web application firewall

- SSL/TLS encryption

- Anti-DDOS attack

How to Use 3Commas

Outlined are steps to get started using the 3Commas trading platform:- Create an account.

- Choose the bot type; there are four bots available: trading bots, short bots, simple bots, composite bots, and composite short bots.

- Connect an exchange.

- Choose a trading pair and set the base trade size.

- Set target profit.

- Choose to take profit type.

- Set max safety trade count.

- Set price deviation to open safety trades.

- Set trade start conditions.

How to Profit from Using the Automated Bots

After setting up the bot, you can begin carrying out long or short trades. In short trades, a price rise in the selected currency results in the execution of the sale of the associated cryptocurrency when the set profit level is reached. In case of a price reversal, you can place safety orders to ensure the bot makes purchases at a particular percentage increase. The traders’ diary gives you access to a report on all linked exchanges. It lets you quickly identify any profits or losses incurred on trades within specific time frames. This feature is suitable for measuring the performance of your bots.3Commas Free Trial

The platform also offers a free trial to try out the features available on the platform and features that work best with your trading strategies. Although 3Commas is not the only trading bot service available in the crypto market, it is affordable and easy to navigate.