Crypto staking is an alternative to mining for investors looking to increase their cryptocurrency holdings and passive income. You can “stake†a part of your or other cryptocurrencies to contribute to the blockchain network for a specific time. Participants may get extra cash or tokens as a reward for their efforts. This article will answer “What is staking crypto?”, how to do it yourself, and the pros and risks.

What is Staking Crypto?

Staking your crypto assets is one of the most attractive methods to earn passive income. The benefits could be pretty enticing if you have extensive Bitcoin (or other crypto) holdings. Proof-of-work (PoW) and proof-of-stake (PoS) consensus approaches depend on cryptographic proofs of work. Consensus techniques are used to validate the legitimacy of a transaction. A valid transaction creates a new block on the blockchain. These protocols, in essence, protect the network. We need to understand proof of stake to get a clearer idea about what is staking crypto.

What is Proof of Stake?

Proof of stake is a way of reaching an agreement to process transactions and add new blocks to a distributed ledger (blockchain). Validators in a proof-of-stake network process transactions and add them to a distributed ledger for the same purpose miners do (such as Bitcoin). Instead of racing to solve complicated mathematical problems like miners, if you’re a node (a computer that participates in the blockchain), you deposit a predetermined proportion of your holdings (or “stakingâ€) into the system. Each block’s validators are picked randomly from those staked with a minimum quantity of coins in the network. Finally, the validated block is verified by additional validators, who verify the block. A validator may lose part of a blockchain’s native currency if the block contains a fraudulent transaction.

To pick the next validator to verify the block, proof of stake employs parameters such as how long the validator has retained their stake, how much stake they have, and how much randomness is thrown in. Proof of Work (PoW) requires miners to solve a challenging math problem to earn a block. Still, our staking solution requires far less processing power and energy because it consumes less energy and is more ecologically friendly. They use proof of stake rather than labor, resulting in faster transaction verification.

Coins You Can Stake

After understanding what is staking crypto, you may think you can stake all coins. However, you can stake only a chosen number of coins, depending on what’s supported by the staking platform or cryptocurrency exchange. Here are just a few examples of coins you can stake.

â— Ethereum

In Ethereum, a PoW method was replaced with a PoS mechanism. According to the Ethereum website, you need at least 32 ETH to stake Ethereum on your own. According to the website, you will “build new blocks†in storing and conducting transactions. Many exchanges, such as Coinbase, allow you to stake Ethereum without needing to own 32 ETH.

â— Cardano

Investors can allocate Cardano (ADA) to staking pools to maximize their earnings. Cardano users do not need to be able to operate a staking pool to set up a stake pool. Cardano can be staked on Coinbase and other exchanges.

â— Solana

Even if a digital wallet does not enable staking, Solana, or SOL, may be staked or delegated. You can stake Solana on Coinbase and other exchanges.

How to Stake Crypto?

After understanding what is staking crypto, you must understand how to stake crypto. If you want to stake on your own, it can be a complicated process, and you typically need to own many of the cryptocurrency assets you wish to stake. However, there are crypto-staking solutions with lower entrance hurdles.

There are the following two options to stake your crypto:

- Staking pools

- Exchanges

Staking Pools

Staking and P2P Validators are only two of the many staking pools available. Crypto assets from diverse contributors are “pooled†together on these platforms via “staking†techniques. Consequently, the stakes are smaller than if everyone became their validator.

Exchanges

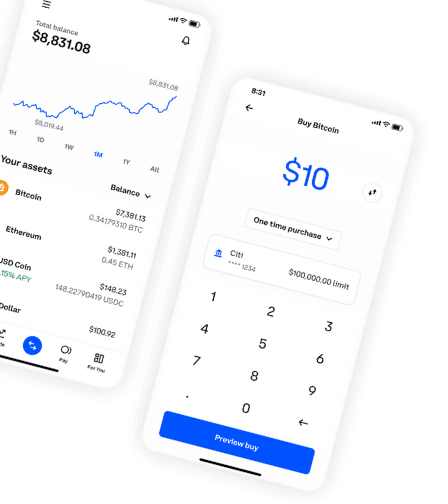

For most cryptocurrency owners, staking on exchanges is the most practical and accessible choice. Coinbase and Binance provide staking services to Bitcoin investors. Withdrawals may be made once a day or once a quarter, depending on the number of cryptocurrencies in a wallet. The staked Bitcoin does not have to be purchased through the Coinbase exchange to stake it. Binance is now one of the complete crypto staking systems available. Staking up to 112 tokens over 30, 60, 90, or 120 days is permitted.

Calculating Your Staking Rewards

This question cannot be answered quickly. Each blockchain network typically has a distinct method for calculating the rewards for staking its currency.

Adjustments are performed on a block-by-block basis, with a broad range of criteria considered at each level. These are as follows:

- How much money does the validator put up as a bet?

- When the validator first started actively investing

- How many cryptocurrency coins are being staked right now?

- the inflation rate on an annual basis

- Other factors

The stake incentives in some networks are predetermined at a certain percentage level. Rewards for validation are distributed to compensate for the effects of inflation. Inflation encourages consumers to spend their coins rather than hoard them, which benefits the overall growth of the cryptocurrency industry. It is now possible to correctly compute a validator’s reward using this paradigm.

Predictable reward schedules may be more appealing to some people than probabilistic block payouts. As a result of the information becoming publicly available, there is a possibility that a more significant number of people will engage in staking.

Pros of Staking

The practice of staking carries with it a plethora of benefits and rewards. Several of the most noteworthy include the following:

â— Requires Fewer Resources

Staking requires far less time and energy investment than mining cryptocurrency, making it a less stressful alternative. Staking is another method that should be considered to enhance the value of your holdings by decreasing the available supply of tokens to serve the ecosystem’s needs.

â— Opportunity to be Involved

Individuals with a more extensive financial interest in a particular ecosystem or blockchain network have a more significant influence over what happens next for a specific cryptocurrency. It is analogous to holding shares in a company. Staking gives you the right to vote in any elections that are held.

â— Easy to Handle

For investors who utilize an exchange to get things started, staking may involve nothing more complicated than pressing a few buttons. From that point on, they will be able to monitor the development of their investments and see the results. Managing your financial portfolio may be done with little to no work and little involvement from you.

â— Interest-Earning

Increase the amount of money or tokens you now have at your disposal. Stakeholders are not guaranteed anything because the process of creating new blocks and awarding rewards is random; however, by participating in the staking process, they earn interest.

Risks of Staking

Staking, like any other type of investment, has potential drawbacks. Even though it is unlikely that your entire portfolio will vanish in a single night, there are a few things to consider before you begin staking.

â— Volatility

During the staking period, you cannot withdraw or sell your cryptocurrency. For example, if the unstake period is three days and the market crashes, you’ll have to wait three days before you can sell your crypto. Cryptocurrency is very volatile, so we typically don’t recommend staking your entire portfolio.

â— Lock-up Periods

Because staking requires you to deposit your money in a trust for an extended period, you won’t be able to access it for several days, months (or years). Once you begin staking, there may be no quick way to “unstake†or recover your assets.

â— Slashing

When you set up and configure your node to stake cryptocurrency outside of an exchange, you risk making a mistake that results in financial penalties. “Slashing†refers to the practice of slashing “validators who are performing poorly or dishonestly.â€

â— Transaction Fees

You will be charged transaction fees when you stake your tokens on an exchange. The costs vary from exchange to exchange; however, they are frequently expressed as a percentage of a staker’s benefits.

The Bottom Line

Cryptocurrency investors have various options for making their money work for them and earning interest and rewards. Furthermore, you may get involved in the governance and validation of the blockchain network, which may be of interest to some investors. Staking is similar to investing money in a company and profiting from it or even putting money in a bank account and earning interest. Before you begin staking your account for growth, you should conduct some research and become familiar with the potential risks.

Frequently Asked Questions

We anticipate that understanding staking crypto will raise several concerns. So we’ve compiled a list of some of the most common ones related to what is staking crypto.