Staking is a profitable and beginner-friendly way to make money off your current crypto investment. Keeping a tab on the market and utilizing the market direction to benefit your investment strategies requires time and resources that not everyone has to spare. Staking enables crypto traders and investors to earn rewards on coins they own. Crypto staking platforms differ based on different factors. The best crypto-staking platforms provide profitable reward systems, sound security, and a friendly user interface. Â

The best crypto-staking platforms also make the staking process more accessible and offer higher rates (some as high as 20 percent per annum). Today, there are numerous staking platforms on the crypto market, and this article aims to help you make sense of the options and bring the best staking platforms to your fingertips.Â

- Also learn about:

Best Crypto Staking Platforms

Binance

Binance is known for its user-friendly interface and broad ecosystem. The platform has an earn feature for its crypto savings account, Binance Earn. It is amongst the best staking platforms due to its wide range of features. You select an option that suits you best depending on your appetite for risks, intended returns, and time horizon. This staking platform offers three possibilities: flexible savings, locked savings, and locked staking. All three can be used to earn passive income on your investment, but locked staking is originally intended for PoS (Proof of Stake) staking. You could also lock your PoS coins for staking rewards for periods ranging from a week to 3 months. The higher the holding period, the higher the staking rewards you stand to earn.Â

BlockFi

BlockFi is renowned for its competitive returns to users with staking rewards. Investments suitable to earn rewards are the ones deposited in the BlockFi Interest Account (BIA). Assets there incur monthly compounding staking rewards from Day 1 of the deposit. The dividends are paid to account holders every month’s end.Â

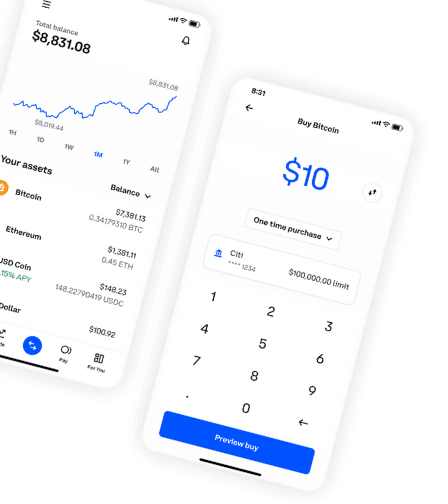

Crypto.com

Crypto.com is suitable for users that trade mainly using a mobile application. The navigation tools are simple and intuitive, and ideal for even novice traders. Staking rewards on Crypto.com are calculated every 24 hours and distributed every week. Like other staking platforms, higher staking time equates to higher rewards. Â

Staking and reward programs vary depending on which app you use. Crypto.com has a minimum deposit limit which changes from one cryptocurrency to another.

Kraken

Instead of saving your rewards on the Spot platform on Kraken, you can invest your deposits in the staking account to earn rewards. Rewards are deposited bi-weekly, and you can withdraw your assets whenever you choose without any fines. However, some coins on Kraken have a “bonding period.†Cryptocurrencies in this category are only suitable for earning rewards after completing the bonding period.

Coinbase

Coinbase offers a limited number of coins for staking and rewards. However, users on the Coinbase wallet service have more options (26 instead of 5 on the central platform). Dividends are usually issued daily or quarterly, depending on the asset you are staking.

Gemini

Gemini supports more than 40 cryptocurrencies available for staking and rewards on its platform. Although Gemini Earn is not precisely a staking program, it is a leading platform for users to issue their crypto holdings as loans in exchange for interest payments. Users earn annual percentage yields for participating with their crypto holdings. Gemini is simple to use, has a user-friendly interface, and is available in every U.S state.Â

KuCoin

KuCoin enables users to participate and earn various rewards on their crypto investment. The KuCoin Earn feature allows you to accrue promotions, savings, or staking rewards. As an example, Ethereum currently has a fixed interest rate of about 4.7 percent yearly.Â

AQRU

AQRU is a staking platform that is quite easy to navigate and flexible to use. Users can stake coins like USDT, USDC, DAI, ETH, and BTC. AQRU enables different payment options, from crypto and bank transfers as well as a credit card. There are no deposit costs or lock-in periods. Funds can be withdrawn within the day of the deposit. Staking rewards are distributed every day and tracked to the core. Withdrawal fees are charged for crypto withdrawals, but fiat currency withdrawal attracts zero fees.

AQRU is also adequately secured using a multi-layered insurance policy and the latest technology from Fireblocks – MultiSig.

Pros and Cons of Staking Crypto

Pros

There are good reasons to stake your crypto investment; some of these include:

- You earn rewards – Staking enables you to create passive income and build your investment portfolio.

- It is easy – Crypto staking does not require any special training or knowledge for you to be profitable. No technical expertise is required.

- It benefits the blockchain – Proof Of Stake cryptocurrencies require users to stake transactions on the blockchain to be verified.Â

Cons

- Volatile crypto market – Due to blockchain volatility, you could lose money if the price you staked your crypto declines. To minimize the risks, you can consider staking stablecoins, which are less volatile.Â

- Scams – Be careful when you come across smaller cryptocurrencies that offer very high reward rates (more often than not, they are designed as cryptocurrency pump and dumps).

- Inaccessibility – When your crypto is staked, you cannot use it for other purposes. Although some platforms enable you to unstake your crypto at any point, this may not be instant, and the delays might have a negative effect if you want to sell during this time.Â

To Stake, Or Not to Stake?

If you have crypto that you do not intend to trade or use for any other purpose in the near term, then staking is a viable option. If you do not have any crypto you can stake, then you can research the cryptocurrencies worth staking.

However, you should only buy crypto for staking if you think it is a good investment decision; the PoS model benefits crypto investors and the blockchain. The process enables the blockchain to process large numbers of transactions at low costs while the investors also earn passive income.