Are you a beginner and want to start investing in cryptocurrency? Unsure where to start? Thankfully, you don’t need to be a cryptocurrency expert or software developer to start investing early on in the development of the cryptocurrency space. This article will cover how to invest in crypto immediately and in a simple way that even beginners can understand. For the purpose of this article, we will be showing you how to invest in Bitcoin, but these steps can be used for any other cryptocurrency as well.

What is Cryptocurrency and Its Importance?

Before you start putting your hard-earned cash into the market, it’s important to understand exactly what cryptocurrency is and its importance to the world. Cryptocurrency is simply peer-to-peer transactions. An example of this is if someone sent you money on PayPal or Venmo, it currently needs to go through a 3rd party (PayPal, Zelle, Venmo, etc) to get to you. Using cryptocurrency would allow this transaction to go straight from the sender to you, with no 3rd party involved.

![How to Invest In Cryptocurrency for Beginners [Ultimate Guide] 8 Investing in Cryptocurrency for Beginners](https://cryptocurrencyhaus.com/wp-content/uploads/2022/02/Investing-in-Cryptocurrency-for-Beginners.jpg)

These 3rd party payment providers carry their own set of risks. There have been a ton of hacks and even lawsuits with the Federal Trade Commission that have occurred because of these services. Another thing people don’t realize is that a lot of these payment providers will sell your data for a profit as an exchange for using their services. This is typically in the fine print that most people don’t read. By using these providers, you are basically helping them profit from your personal information and the fate of your money lays in their hands.

With cryptocurrency, you own your finances. This means that you hold what’s called “wallet addresses.†These addresses are simply extremely long addresses that consist of numbers and letters that are completely unique to you. You have “Deposit†addresses and “Withdrawal†addresses. Because these addresses are so unique, you don’t ever have to worry about transactions getting hacked or reversed due to the security of the blockchain system.

This is the basis of how all cryptocurrency works.

What is Bitcoin?

uses this same peer-to-peer technology that operates with no central authority or banking system. It truly allows its users to be their own banks. The issuance of Bitcoin and management of transactions are done through the Bitcoin network. This network is open-sourced (public) which means no one person or entity controls Bitcoin. Some benefits of using Bitcoin are:

- Quick peer-to-peer transactions – Imagine doing a wire transfer. Sometimes these can take days or weeks to complete and sometimes come with a large fee if you want it expedited. Bitcoin solves this problem by skipping the middle man (the bank) and providing super-fast transaction times.

- Low fees – To use Bitcoin, you will pay a small fee that goes to the miners. These are people that mine the data for the transaction all across the world. It’s great to know your fees don’t go to the banks; they go to the people helping to complete your transaction!

Check out the infographic below to get an idea of how Bitcoin works.

![How to Invest In Cryptocurrency for Beginners [Ultimate Guide] 9 How Bitcoin Works](https://cryptocurrencyhaus.com/wp-content/uploads/2022/02/How-Bitcoin-Works.jpg)

There is an that you can check out if you’d like. Keep in mind, I would not consider this whitepaper “beginner-friendly.†It’s pretty complex in explaining the technical details of how Bitcoin works, but it goes to show you that it is a real technology with a powerful use case.

What is the Blockchain?

Simply put, the blockchain is a decentralized system that cryptocurrency runs off of. There is no central authority or bank that controls it. Anyone can look up all of the transactions that occur on the blockchain (however, all users are anonymous). I encourage you to actually check it out for yourself to get an idea of how it works!

Whenever a transaction occurs, the transaction goes out to a network of miners all across the world. These miners are the people responsible for transactions to complete. Basically, how mining works are the computers on the network solve mathematical equations that will confirm if the transaction is legitimate or not.

How to Choose a Cryptocurrency Exchange

There are many exchange options out there, so it can quickly become overwhelming on which to choose. The major ones are fairly similar, and they are all competing for your money. Typically, most people choose one exchange and stick with it, and this is great news for you. Because of the high competition, exchanges are offering incentives and sign-up bonuses that will give you free cryptocurrency. We’ve written a complete comparison of some of the major exchanges, including the current offers for you. For beginners, I highly recommend Coinbase and you can get $10 for free when signing up if you use the link below. If you sign up and don’t use our incentive link, that’s fine, but you won’t get the $10 for free.

How to Invest in Crypto With Coinbase

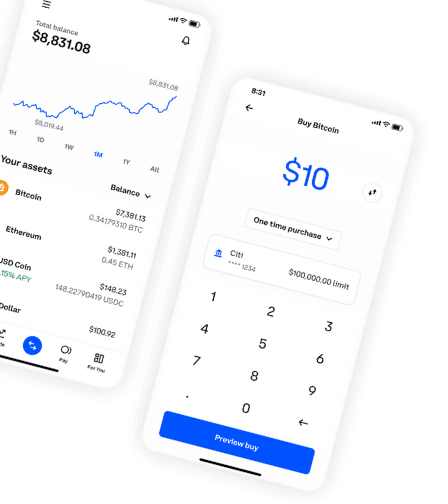

For demonstration purposes, we will be using Coinbase to invest in crypto (Bitcoin), which is the most beginner-friendly exchange in my opinion.

Step 1: Complete Coinbase Account Sign Up

Once you’ve clicked on the special incentive link (to get $10 free) and go through the account creation process, you’ll arrive on the Coinbase home page. You’ll want to check the price of Bitcoin because this will be the price you will be entering the market at. And don’t worry – you do NOT have to (you can buy a fraction, which is what most people do). I like to look at the long-term trends, and if we look at Bitcoin, it’s had its highs and lows but has consistently been increasing in value over the years.

Step 2: Invest in Amount You’re Comfortable With

For our example, we will purchase $200 of Bitcoin (you won’t get the incentive bonus if you invest less than $100). Click on “Bitcoin†and enter the amount you’d like to buy. You will be asked to link your bank account or debit/credit card and it’s safe to do through Coinbase. Then, click “Preview†and it will show you how much Bitcoin you’ll get for the amount of cash you want to invest. If it looks good, click “Buy Now.†And that’s it – you did it and invested in your first crypto!

How to Cash Out Crypto on Coinbase

Many people buy cryptocurrency with the intention to sell it. Selling your cryptocurrency is fairly easy but let’s go through how to do it. In this example, we will use Bitcoin. All you will need to do is click on the cryptocurrency you’d like to sell, then hit “Trade†and “Sell BTC.†After you sell the amount you’d like, you will now have USD in your Coinbase account. To transfer this to your bank, click on USD, and then “Cash Out.†Your USD will now be transferred to your bank account.

Navigating Cryptocurrency Taxes

Yes, cryptocurrency IS taxable. I wrote an entire guide on cryptocurrency taxes that you should read, as well as a full review of the best cryptocurrency tax software to make your life easier. The goal of the government (especially in the US) is to tax pretty much anything possible, and that includes crypto. If you receive crypto as payment, sell, or trade your cryptocurrency for another type of cryptocurrency, you are liable for taxes. There are also a lot of other factors that go into it, so check out the guide above for detailed information.

If you are trading large amounts of cryptocurrency, I highly recommend getting in touch with a certified tax professional so you ensure that you not only complete your taxes correctly but also get any exemptions that you may qualify for.

How to Keep Your Cryptocurrency Safe

There are many actions you can take to keep your cryptocurrency investments as safe as possible. As cryptocurrency continues to gain mass adoption, there are a lot of scammers that try to take advantage of new investors. Below I outline a few things you can do to keep your investments safe and out of the hands of hackers and scam artists.

Buy a Hardware Wallet

Purchasing a cryptocurrency hardware wallet is one of the best things you can do to keep your crypto investments safe. A great aspect of cryptocurrency is that you don’t need to keep it on an exchange such as Coinbase or Robinhood. You’re able to transfer it between exchanges, as well as off of the exchange on a USB-like device called a hardware wallet. A hardware wallet is the safest place to store your crypto.

I wrote a full guide on the best cryptocurrency hardware wallets on the market today. Thankfully, the hardware wallets are easy to use even for beginners. Each wallet comes with explicit instructions on how to load your cryptocurrency onto the wallet, and how to transfer it from the wallet back onto the exchange.

After purchasing your cryptocurrency, I recommend storing it in a hardware wallet until you’re ready to move it back onto the exchange to sell or trade for another currency. Alternatively, you can use a free software wallet such as MetaMask.

Learn About Common Cryptocurrency Scams

Cryptocurrency scams are a dime a dozen. The best piece of advice I can give you is that if it sounds too good to be true, it probably is. Scammers prey on newbies who hope to get rich quickly from cryptocurrency, and scamming is a business model that won’t be going away anytime soon. I cover some of the in a previous article that I recommend you read and share with your friends and family sooner rather than later.

Use 2-Factor Authentication On Your Account

2-factor authentication is one of the easiest security protocols that you can use to protect your cryptocurrency assets on an exchange. The major exchanges such as Coinbase and Binance offer this additional level of protection. Essentially, 2FA is simply a second way (other than your username and password) to ensure that the login to your account is really YOU.

This second authentication method might be through Google Authenticator, a text message code, phone call, or email. It’s an easy security layer to set up for your account and yes, it takes a few extra seconds to log in, but that’s better than your account getting hacked!

Market Conditions and a Warning

I like to be completely transparent when discussing cryptocurrency and market conditions. Cryptocurrency is an extremely volatile investment that can swing wildly in the positive or negative direction. It’s a common occurrence for even mainstream cryptocurrencies, like Bitcoin, to go down by 30% one week, and up another 30% the next week.

Keeping this in mind, cryptocurrency investing is not for everyone. If you are uncomfortable with high-volatility markets, then I would not recommend you invest right away. Instead, it’s best to get educated on cryptocurrency and start looking at the markets on a daily basis so you can get an idea of what to expect. I recommend only allocating a small amount of your portfolio to cryptocurrency when you’re getting started.