Tokens vs. Coins

Before we jump into the discussion of equity tokens, it is important for us to know what is the basic difference between coins and tokens. They both fall under the huge umbrella of cryptocurrency, but they share some unique features which make them different from one another. From an end-user perspective, they can be considered one and the same. However, there are technical differences in how they are developed on a blockchain. A coin is a native asset of a single blockchain, whereas tokens are designed by platforms and applications on top of a pre-existing blockchain. and Ethereum are examples of coins, whereas MATIC, LINK, and USDT are examples of tokens. Coins are the core pillar of a blockchain. There can only be a single native coin for a specific blockchain. However, you can have hundreds of tokens built on top of a blockchain. Tokens are basically used for real-world applications of the blockchain. When a token is created in a blockchain, a developer does not have to write a code, nor does he have to be anxious about how the transactions would be validated. But a coin, on the other hand, is responsible for keeping track of the data of the blockchain, storing its value, and validating transactions. That is why they are said to have a much higher intrinsic value than that of tokens.What are Equity Tokens?

Equity tokens serve to represent equity in an underlying asset. These assets are usually shares of a company. With the massive uprising of cryptocurrency, companies are looking forward to adapting digitized versions of their equity shares and, thus, the introduction of equity tokens. Equity tokens are a trending and convenient way to raise capital where companies are issuing shares in the form of digital tokens. Equity tokens have become popular only recently due to the upsurge of decentralized blockchains. These blockchains enable companies to easily create, issue, and transfer digital tokens.Understanding Equity Tokens

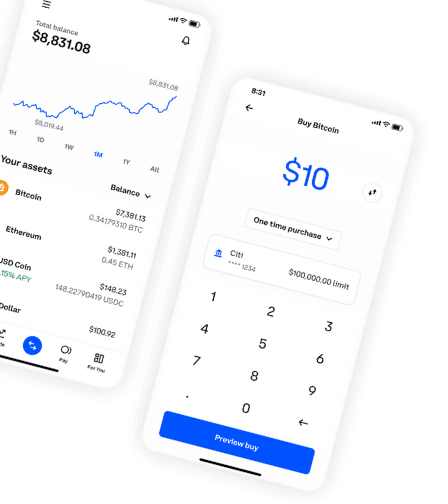

The unique feature of an equity token is that they are basically shares of a company, but they live on the blockchain. You share ownership of the relevant blockchain project as a holder of an equity token. As a shareholder, you are also entitled to have control of the company, and this will depend on the number of shares (tokens) you hold. You can compare these equity tokens to buying shares of a publicly traded firm at its initial public offering or on the stock market. When you buy a share, your brokerage account gets credited. The same principle can be applied to equity tokens; in this case, tokenized equity shares are instead credited into your The conventional method of fundraising faces several operational challenges. Strict rules of the stock exchanges, the difficulty in persuading retail investors, and the reluctance of big financial institutions to lend money are some of the common challenges these companies have to face regularly. However, tokenizing firm ownership as equity tokens on a blockchain gives the company much flexibility. The low-cost approach enables a more democratic technique of genuinely valuing the company based on the active involvement of interested investors. Instead of being heavily influenced by a small number of sponsors or angel investors, market forces mostly determine the value.How are Equity Tokens Issued?

There are basically two ways of tokenizing the asset of a company:- Private Token Sale

- Public Offering of Tokenized Equity

- The business must first sign up for an exchange platform. This platform will make the path to releasing its equity token easier. It will also assist in maintaining a record of its data.

- Next, it is time to inform brokers-dealers and prospective investors of the business terms and conditions governing the sale of equity tokens.

- A pre-ETO campaign may be run to distribute a certain number of tokens to a select group of participants. This will make it easier for other people to understand the importance of the equity token sale.

- The tokens are offered to the general public if a sufficient amount of funds is not raised during the private sale. This public includes retail investors as well as companies.