What are Utility Tokens?

What are utility tokens? As its name implies, the value of utility tokens is dependent on the blockchain with which it is associated. Although the value of a digital coin also depends on the internal blockchain, the dependence is partial; market forces also have a high impact.What are Security Tokens?

What are Coins?

Use-cases of Utility Tokens

Utility tokens are usually used in projects in their commencement stage and during ICO (initial coin offering). Utility tokens are used differently based on their associated project. Some utility tokens and their use cases are:-

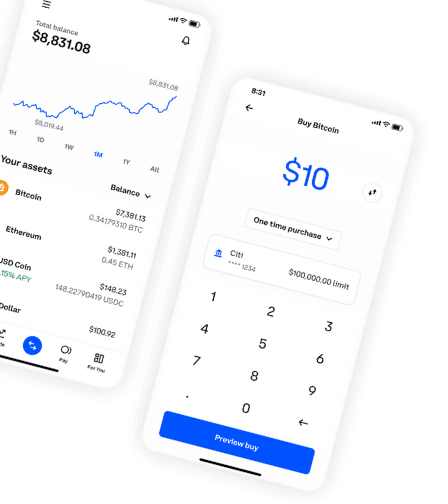

- Cronos (CRO) – Cronos is the utility token of Crypto.com and is used by users to get discounted trading prices and other exclusive benefits like preferential rates, token allocation, and higher earnings. Crypto.com is an exchange platform that offers multiple services, from brokerage to lending and DeFi.

-

- Uniswap (UNI) – This utility token is a governance token that enables users to participate in the platform’s governance. Uniswap is a platform where users exchange one ERC-20 coin for another without going through a centralized exchange and the risks involved. The token was introduced in 2020 through an airdrop in September 2020.

-

- Golem (GNT) – This utility token was established based on a project that aimed to enable users to rent available computing power in the decentralized network.

-

- Bitcoin.com (Verse) – Bitcoin.com reward token, Verse, acts as a gateway for holders regarding all related Bitcoin services, from non-custodial multi-coin wallets to educational material and news. The platform plans to make even more adjustments to enable Verse token holders to reap more benefits. They will be able to stake their token for rewards in utility pools and use it to access many decentralized finance services.

-

- Klever (KLV) – The KLV utility token is used by Klever community members to access any service on the exchange platform. Holders can use their utility token to pay for blockchain fees, receive and make payments, and purchase NFTs from the Klever platform. The Klever exchange platform is designed to minimize barriers to entering crypto for new members as much as possible.

Benefits of Utility Tokens

Utility tokens may become less critical in the coming days of the crypt market. However, some projects still deploy utility tokens for the value they provide to users. Some of the pros of utility tokens are:-

- It is easy to fund Dapps (decentralized applications) using utility tokens. Blockchain software developers can boycott complex financial security regulations from the government while still getting sufficient funds to develop their projects.

- Utility tokens are versatile. Unlike security tokens, users and developers can use them for a host of functions, which is why they are preferable.

- Utility tokens are attractive for adaption by organizations. Utility tokens provide an easy method for businesses to raise money without battling security regulations; thus, more companies are likely to adopt utility tokens – leading to an increase in demand; and value.

- Utility tokens are an excellent way to build community. Because utility tokens can be used to provide incentives, they are ideal for attracting users to participate in a project.

Disadvantages of Utility tokens

-

- Since financial security laws do not back utility tokens, scammers can use them to lure investors into losing their money.

- Utility tokens depend on the success of the associated project, meaning they are highly volatile.

- Utility tokens may not reach the capital necessary for the project, thus, posing a liquidity problem.