With the increase in popularity of cryptocurrency and the number of investors seeking to profit off the over 2 trillion dollar industry, Coinbase, a cryptocurrency exchange platform, has equally been brought into the limelight. Millions of people sell and buy different digital currencies daily and use them as a payment medium, and a Cryptocurrency exchange is necessary. Coinbase is one of the most effective ways to purchase cryptocurrencies such as Bitcoin, Ethereum, Luna, and Dogecoin online, and plays host to over 90 different types of cryptocurrency. However, not every cryptocurrency is supported on the exchange platform. Here you’ll find everything you need to know in this Coinbase review before choosing it as your primary exchange.

- Also learn about:

Coinbase Key Features

| ? Number of Cryptocurrencies Offered | Over 150 |

| ? Crypto-to-Crypto Trading Pairs Offered | Over 450 |

| ? Fees | 0.5% to 4.5% depending on payment method |

| ? Minimum Trade Amount | $2 |

| ? Mobile App | iOS and Android |

| ? Exchange Support | Email, Live Chat, and Phone |

| ? Altcoin Options | Limited |

Use the link above to get $10 in free crypto when you make your first trade.

Coinbase Overview

A review of the Coinbase profile reveals that the company currently has over 98 million users worldwide and 256 billion dollars worth of assets on the platform. It was established in 2102, primarily as a platform for the trade of . Today the company has almost 5000 employees across the globe and works as a decentralized company with no particular headquarters.

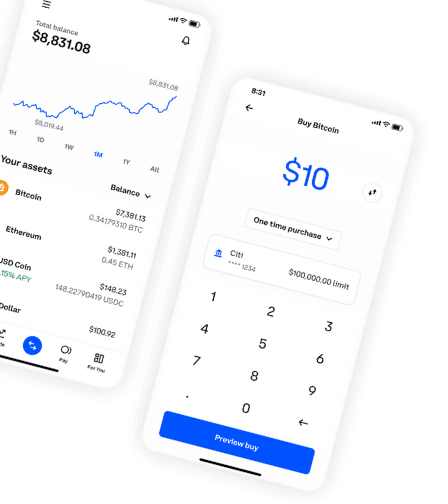

Coinbase runs two different platforms alongside a cryptocurrency wallet service. Coinbase is the app used to buy, store, and trade cryptocurrency, while Coinbase Pro is a professional asset platform for digital assets. Coinbase also recently released Coinbase NFT, which is a marketplace where NFT collectors and artists buy and sell digital NFTs.

Pros and Cons of Coinbase

General Coinbase review: Coinbase offers broad access to over 100 cryptocurrencies and has a low minimum required to fund one’s account. However, it uses higher fees when compared to other crypto exchanges.

Coinbase Review: Where Coinbase Excels

- Cryptocurrency selection – Coinbase users have access to a wide range of digital currency offerings because the platform has recently expanded its coverage to over 150 cryptocurrencies.

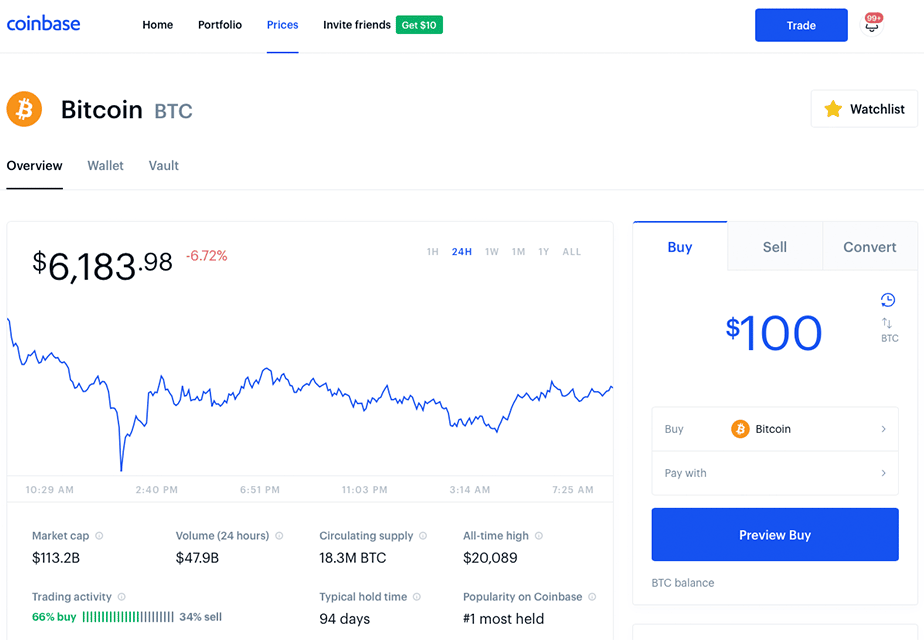

- Trading platforms – Users have access to different platforms for trading. The original Coinbase platform has a user-friendly interface that gives users the option to purchase cryptocurrency using US dollars. The Coinbase Pro platform has advanced charting functions and enables users to place stop orders, market limits, and carry out crypto-to-crypto transactions directly. The company is also working on a new function called Coinbase one, which costs 30 dollars in May 2022 while undergoing beta testing. This feature offers no-fee trades and a couple of other benefits for a subscription fee paid monthly.

- Coinbase Earn – This feature allows users to make money while learning. Coinbase offers educational materials in the form of video classes and exams to users in crypto trading and new cryptocurrency.

- Debit card access – Coinbase issues a visa-branded debit card linked to the Coinbase wallet balance of users. This enables users to easily spend their cryptocurrency at any merchant that accepts Visa payments worldwide.

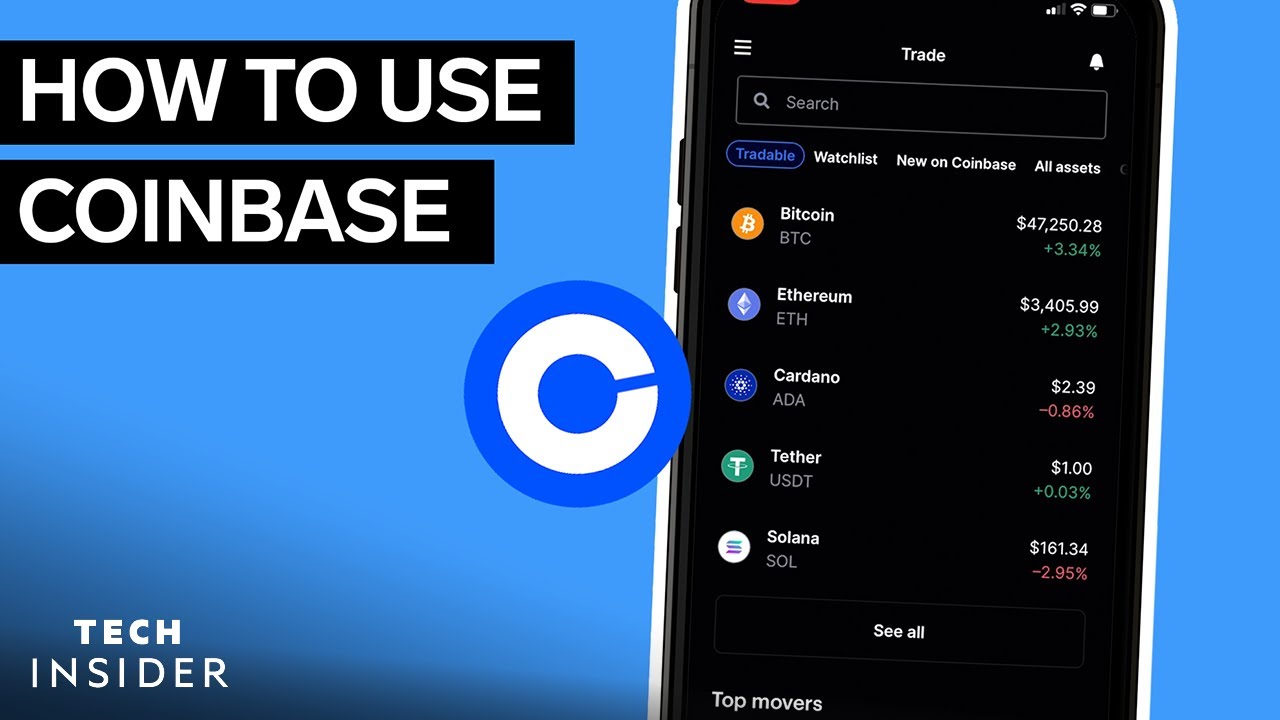

- Mobile app – Coinbase offers its users a friendly user interface and efficient mobile app for selling, buying, and trading crypto anywhere. Irrespective of the device, the mobile app works well for mobile crypto trading.

Coinbase Review: Where Coinbase Can Improve

- Fees – Coinbase has a confusing fee structure that tends to be higher when compared to other cryptocurrency trading platforms. You can view the cost of a trade when you preview the transaction, but it is hard to figure out the price of a trade beforehand. The minimum amount required to purchase cryptocurrency using the Coinbase platform is $2. The elements that make up the fee structure of the platform can be classified into three categories: 1. The charges on cryptocurrency sales and purchases. 2. Charges are based on payment, order size and volatility, and liquidity. 3. Fees are required to cover expenses for executing a transaction on the external blockchain supporting the cryptocurrency the platform deals with.

- Privacy – Perhaps, the biggest downside of the Coinbase exchange platform is privacy. The exchange tracks all transactions carried out on your account. In 2029 the platform reportedly hired employees from the hacking team. This is in sharp contrast with Bitcoin’s trait of maintaining anonymity.

- Customer service – Coinbase has many negative ratings for customer service, and this includes even account security issues.

- Limited altcoins – Although Coinbase offers access to a wide range of digital currencies, many are still not available on the digital currency exchange platform.

How Safe is Coinbase?

Coinbase uses top industry security and safety practices to protect its users’ assets and deposits. However, using digital currency comes with a healthy dose of risk, and you should follow best practices to keep your investment and account information safe online to avoid .Â

A review of Coinbase safety measures shows Coinbase uses bank-standard encryption and security for its website. It also stores 98 percent of users’ assets offline using safe deposit boxes that have digital and paper backups distributed around the globe. Accounts have a double factor authentication which prevents hackers from gaining access to your account without physical access to your mobile device.

Despite these security methods, users have suffered considerable losses to hackers who have gained access to their account details.

However, the exchange platform has never recorded an incident of its treasury funds losing funds to hackers. Only individual users lost access to their accounts.

Services Offered by Coinbase

- Brokerage – Coinbase does not issue “crypto securities” at the moment. However, it announced its intention to become an SEC-regulated crypto broker. For now, the Coinbase platform is not a broker-dealer.

- Exchange – Coinbase has been an exchange platform for almost a decade. In 2015, a sub-professional trader-friendly platform, GDAX, was launched, and in 2018, GDAX’s new name became Coinbase Pro. Using Coinbase Pro, trading is incentivized by offering lower fees and three times margin trading.

- Staking services – Verified users on Coinbase can stake Tezos(XTZ) by holding two or more Tezos in their accounts and signing up for delegation; users stand a chance to earn results from staking. Rewards are distributed to users depending on how many Tezos they have.

- OTC trading – Since 2018, Coinbase has enabled OTC trading for its institutional customers, and the company explained in March 2019 that its OTC desk sells coins directly from cold storage.

Other Exchanges to Consider

- Webull – This exchange is preferable if you like to trade stocks as well as crypto, it doesn’t have as many altcoins as Coinbase but is preferable for keeping all of your investment portfolios on a single platform.

- Gemini – If you like to earn interest on your crypto, Gemini has a decent earning program that allows you to earn passive income from your crypto-investment

The Bottom Line

Coinbase is undeniably among the top crypto exchanges in the US. Its interface is user-friendly, and it offers a good measure of security. For new investors in the crypto space, Coinbase is excellent, but for traders and bitcoin enthusiasts, Coinbase might not be the best option.

Review Methodology

Cryptocurrency Haus has an in-depth review process that effectively analyzes, tests, and ranks the most popular cryptocurrency exchanges and startup players in the space. Our process uses an iterative approach which is revisited as needed. We take pride in our independent audit of companies to help visitors like you get the information you need to make educated decisions.

Review Process

We collect product and service information directly from company websites, and we undergo first-hand testing and/or evaluation based on company presentations. External reviews by real users may be used in helping to determine a conclusive rating.

Rating Factors

We take weighted averages of consistent markers for each cryptocurrency exchange, such as security, variety of cryptocurrency, fee schedules, customer service, etc. Based on our iterative process, weightings may change depending on changes in factors that occur throughout the company.

Updates to Reviews

Our team re-evaluates almost all reviews annually and makes adjustments throughout each calendar year. Companies are encouraged to reach out with any new updates that our team may miss.